The Week in UK Property: 5 Critical Trends Every Landlord Must Watch

6th October 2025

As the regulatory, tax, and market environment around UK property tightens, the past week has delivered several headline-grabbing developments that may reshape landlord strategy for the rest of 2025 and beyond. For both residential and commercial property owners, staying ahead of these trends is no longer optional.

Below we unpack the five most consequential stories of the past 7–10 days — what’s happening, why it matters, and what you should be doing now.

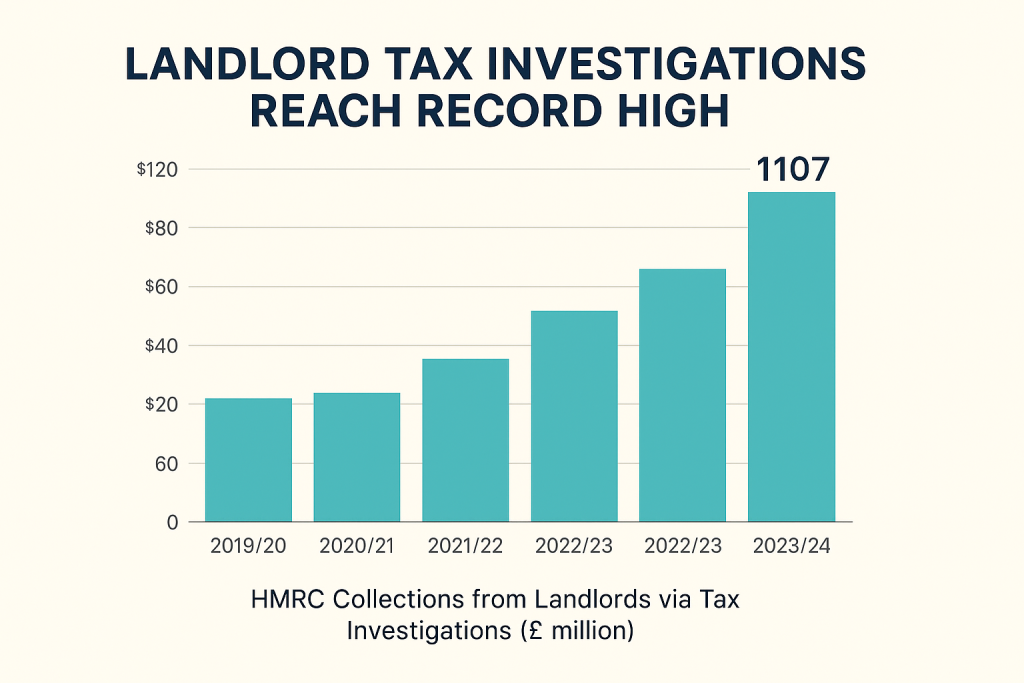

HMRC cracks down: record £107 million recovered from landlord investigations

In the tax year 2024/25, HMRC has clawed back £107 million from UK landlords via investigations — the highest ever total.

Scale & average impact: That sum is more than double the recovery in 2022/23 (c. £65.4 million). The average landlord disclosure in this campaign was around £13,713.

Trigger mechanisms: Many cases stem from HMRC’s enhanced data-matching techniques, taxpayer “nudges,” and the Let Property Campaign (LPC), a voluntary disclosure route.

Common pitfalls:

Misclassifying capital works (which are not deductible) vs maintenance/repairs (which are).Ignoring “phantom profits” — particularly as mortgage interest relief continues being restricted (i.e. taxed “profit” on paper though cash flow may be tight).

Not correctly reporting ancillary income (e.g. service charges, fees) or letting abroad without full disclosure.

Why this matters now

This level of recovery indicates HMRC is intensifying enforcement, especially in the lead-up to Making Tax Digital (MTD) for property (scheduled April 2026).

Landlords who neglected compliance in the past will be under increasing spotlight.

Action steps for landlords & investors

Commission an immediate tax audit / review of past 3–5 years’ returns and expense claims.

Engage a specialist property tax accountant or adviser familiar with HMRC practice on LPC, investigations, appeals.

For those holding high-leverage portfolios, evaluate if incorporation remains optimal (i.e. holding properties via a limited company) under evolving tax regimes.

Enhance bookkeeping systems: ensure clear separation of capital vs revenue expenditures, maintain evidence (invoices, photos, logs).

Monitor HMRC communication: if you receive “nudge letters” or inquiries, respond proactively rather than defensively.

Supply shock: landlords exiting, listings plunge, rents under pressure

A powerful convergence is under way: many landlords are selling up (or planning to), while new rental listings are dropping sharply. The result: constrained supply and upward pressure on rents — even in a strained demand environment.

Landlord exodus intensifies

A growing number of landlords are projected to exit the buy-to-let (BTL) market in 2025.

Surveys suggest nearly 100,000 landlords may sell within the year, building on ~65,000 exits in 2023–24.

This trend is driven by rising compliance costs, legislative uncertainty (e.g. Renters’ Rights Bill), and fiscal changes (interest, taxation pressures).

Listings fall at the fastest rate since Covid lockdowns

According to the Royal Institution of Chartered Surveyors (RICS), its “landlord instructions” index dropped to –37 in August 2025 — the worst figure since April 2020. This signals a steep contraction in the number of new rental properties being listed.

Analysts tie this drop to landlord fatigue, uncertainty over upcoming reforms, mortgage cost pressures, and tax speculation.

Impact on rents & demand

Rightmove reports that average UK rents have reached a record high of £1,577 per calendar month, up ~2.9 % year-on-year (and ~46 % since the pandemic began).

Regional variance is acute: London remains the most expensive, while northern regions like the Northwest show double-digit rent growth (9.7 % in one reading).

Despite this, in many markets demand is cooling (especially at upper echelons of the housing market) as affordability strains bite and potential tenants pause decisions.

With fewer new listings to choose from, tenants may be locked into less choice or pay higher premiums, especially in desirable or high-demand areas.

Why this matters

For residential and commercial (e.g. small retail, industrial) landlords, this behaviour signals a tightening supply/demand imbalance — a potential tailwind for rental yields in many submarkets, though not without risk (tenant default, regulatory cost burden, void periods).

What to watch & do

Reassess rent-setting strategies: in markets with low supply, incremental rent increases may be possible, though legally constrained regions (e.g. Scotland under new cap rules) demand care (see next section).

Prioritize tenant retention: investing in maintenance, communication, amenities may improve renewal rates.

Consider add-value refurbishment / repositioning to differentiate your stock in a tightening market.

For those considering exit: weigh capital gains tax, transaction costs and the timing of disposals against holding longer in a constrained-rental environment.

Scotland’s rent caps & emerging UK-wide tax levy proposals

Two interlinked pressures are intensifying: statutory rent caps in Scotland, and speculation over new UK taxation (specifically on landlords) via the forthcoming Autumn Budget.

Scotland introduces rent cap powers

Scotland’s Parliament has passed legislation enabling local authorities to impose caps on rent increases: essentially, landlords may be restricted to raising rent by no more than 1 percentage point above inflation, with a ceiling of 6 %.

Key exemptions include student housing / mid-market housing schemes, which are excluded from cap powers under the new legislation.

While this applies to new and existing tenancies depending on timeframes, it marks a substantive shift toward statutory rent control in the UK. It is not yet clear if similar proposals will be adopted in England or Wales — but the precedent raises investor risk perceptions.

Proposed landlord tax levies & expansion of National Insurance

In parallel, speculation is mounting that Chancellor Rachel Reeves may include a new levy on property values above £500,000 and proposals to treat rental income as liable for National Insurance contributions (currently exempt) in the upcoming budget.

Under one model, this levy would apply at the point of sale on owner-occupied homes over £500,000.

Another possibility is applying NI on rental profits (i.e., landlords would pay employee-style or self-employed NI on property income). This was explored in earlier Treasury proposals, with potential to raise c. £2 billion.

Critics warn such moves could reduce landlord participation, constrict rental supply further, and drive up rents for tenants. The National Residential Landlords Association (NRLA) has already cautioned against punitive taxation on property owners, emphasizing negative downstream consequences.

What this means for property investors

For landlords operating in Scotland (or planning acquisitions there): run models assuming rent-increase caps of CPI + 1 pp or 6 % max, and examine worst-case scenarios of compressed cash flow.

For portfolios spanning UK regions: monitor whether England/Wales legislation lags or mirrors Scotland’s approach.

Stay nimble: if tax changes are introduced, contingency planning (selling, restructuring, refinancing) may become critical.

In due diligence, budget for stricter compliance burdens, more conservative yield assumptions and potential exit liabilities.

Premium housing and capital gains under pressure

While rental markets show signs of strength from constrained supply, the high-end residential sales market is facing headwinds due to tax speculation and buyer caution.

Cooling in the upper-price brackets

Data from Zoopla suggests that demand for homes priced above £500,000 has softened. New listings in that band dropped ~7%, and buyer demand in the £1 million+ bracket was down ~11%.

This is partly attributed to tax policy uncertainty: prospective buyers are adopting “wait and see” strategies ahead of the Autumn Budget, especially if capital gains tax, stamp duty, or property levies are reformed.

Though average UK house prices are still rising modestly (1.4% in the latest reading), that growth is propped up by lower-value segments. The luxury / upper-end risks stagnation or even correction.

Proposed CGT/levy reforms

As mentioned above, chancellor proposals are reportedly considering levies on homes over £500,000, and possibly stricter taxation on capital appreciation. For residential landlords who sell or flip properties, that could squeeze net returns significantly.

Investor implications & strategy pivots

For landlords who also buy/sell (flippers, reformers): model the impact of higher taxes / levies on exit yields, factoring in transaction costs and holding time sensitivity.

Consider locking in gains sooner rather than waiting, if legislative risk looms.

In acquisitions, allow margin for lower capital growth or longer hold time in modeling.

Diversify portfolio exposure: pair higher-risk premium assets with mid-tier, stable, cash-flowing holdings.

Evaluate whether commercial / mixed-use assets offer more insulation from these headwinds.

Policy & operational flashpoints: Renters’ Rights, EPC pressure & notice period ambiguity

Beyond headline tax and market trends, several more immediate legal and compliance risks have emerged this week — any of which could cost landlords materially.

Renters’ Rights Bill: shorter notice periods, eviction constraints

The Renters’ Rights Bill — potentially law in the coming months — is creating uncertainty around notice periods, evictions, and landlord powers. Landlords have been warned that clauses intended to assist tenants could muddy notice periods and introduce confusion.

With “no-fault” evictions (Section 21) on borrowed time, and more protections proposed for tenants, the margin for landlord error grows.

EPCs, green regulation & landlord exit risks

A poll this week — published on LandlordZONE — showed 39 % of landlords would rather sell than invest in required energy performance upgrades (EPCs).

In Scotland, very rigid EPC timescales were flagged as risking contraction of the private rented sector (PRS) if landlords can’t cope with upgrade costs.

In England/Wales, the push toward net-zero, tightening minimum EPC standards, and rising penalties for noncompliance remain pivotal. Many landlords find themselves squeezed by capex demands on aging stock.

Notice period ambiguity (periodic tenancies)

A specific warning surfaced this week: a clause in the Bill around notice periods in periodic tenancies could generate confusion or unintentionally impose stricter timelines on landlords.

As these changes come in, inadvertent noncompliance or mis-timing could invalidate notices or open landlords to claims or delays.

Additional local licensing & tenant behaviour trends

Selective licensing: some councils (e.g. Croydon) are revisiting local licensing schemes, which may raise fees and standards burden.

Title fraud: landlords are being urged to sign up to the Property Alert Service to guard against fraudsters hijacking titles or deeds.

Secret subletting: a recent survey suggests 68 % of landlords have discovered unauthorized subletting by tenants.

Practical responses

Review tenancy documentation now: check your standard notices, clauses, and procedures for compliance risk under the new Bill.

Plan for EPC upgrades proactively — don’t wait until minimum standards bite.

Monitor local authority licensing proposals in your jurisdictions; respond via stakeholder consultations.

Enroll in title protection / alert services.

Strengthen tenant screening and contract enforcement to mitigate subletting risks.

Integrated Takeaways & Strategic Playbook

When seen together, these stories expose a landlord environment in flux — combining fiscal pressure, regulatory overload, supply contraction, and market segmentation. For serious property investors, adaptation isn’t just desirable; it’s essential.

Key themes & risks

Regulatory burden is intensifying: Tax compliance, new tenant protections, energy regulations and local licensing demands are stacking up.

Supply is shrinking: With many landlords exiting or withholding stock, rental supply may constrict, pushing yields upward in constrained markets.

Tax policy is a sword hanging overhead: Proposals for levies, NI on rents, or CGT shifts could materially alter returns.

Market bifurcation is accelerating: High-end sales segments face more downside risk, while mid-market rentals may remain resilient or even benefit.

Operational risk is mounting: Eviction processes, notice periods, EPC obligations, subletting, and title fraud all matter more — missteps can be costly.

A landlord’s strategic playbook

| Goal | Actionable Steps |

|---|---|

| Shore up compliance & tax resilience | Engage property tax specialists, perform historical audits, upgrade accounting systems, incorporate (where appropriate). |

| Stress-test cash flow & portfolio downside | Build projections assuming rent caps, voids, default risk, increasing compliance costs. |

| Retain tenants, reduce churn | Improve responsiveness, maintenance, services, communication. Lock in lease renewals proactively. |

| Balance exit vs hold strategies | For weaker or high-risk assets, consider disposing early (before tax changes). For stable, well-located rentals, hold and reinforce cash flows. |

| Diversify by geography and use case | Cross-region exposure shields policy/regional divergence. Mixed-use or light commercial assets may offer diversification. |

| Watch legislative calendars & pre-empt change | Monitor Budget leaks, parliamentary stages of Renters’ Rights Bill, local authority licensing consultations. |

| Plan capital expenditures proactively | Strategically phase EPC upgrades, refurbishment, repositioning — don’t be forced into reactive spend. |

| Protect operations & legal exposure | Review all contracts, notices, insurance, title alerts, subletting clauses, eviction procedures ahead of legal changes. |

What This Means for Residential vs Commercial Investors

While many trends cross both domains, it’s helpful to distinguish how residential and commercial landlords should interpret and respond to recent developments.

Residential Landlords

Tax risk: more exposed — smaller margins and reliance on personal income tax regimes. HMRC crackdowns are more consequential for individual small-scale investors.

Tenant relations: more direct impact — retention, satisfaction and service levels can materially influence yields.

Regulation burden: increased risk over EPCs, rent caps (Scotland), Renters’ Rights Bill.

Exit capacity: often easier to dispose residential units, but CGT changes or levies could bite.

Commercial / Mixed-Use Investors

Lease risk & covenant breakage: in a softer office or retail environment, default risk and lease renegotiation are more pronounced.

Valuation sensitivity: capital values are more volatile under interest rate, vacancy, and yield compression pressures.

“Extend and pretend” credit risk: some lenders may prefer rolling term extensions rather than forced sales to avoid crystallising losses.

Operational payloads: compliance with environment, health & safety, local authority licensing can become more costly in commercial buildings.

That said, commercial assets may also retain more flexibility in repurposing (e.g. converting to light industrial, workshops, logistics) or leasing to multiple smaller tenants rather than single anchor tenants.

Looking Ahead: What to Monitor in the Next 4–12 Weeks

To stay ahead, attentive landlords and investors should closely watch:

Autumn 2025 Budget announcements — in particular, any confirmed property levies, National Insurance changes on rental income, or CGT reforms.

Parliamentary progression of the Renters’ Rights Bill — especially clauses on notice periods, evictions, tenant rights.

Implementation schedules in Scotland for rent caps — and potential spillover to other nations.

EPC regulation updates — when new minimum thresholds or penalties are triggered.

Local authority licensing proposals — respond locally and influence consultation outcomes.

HMRC disclosure / enforcement intensification — any signals of expanding data matching or landlord audit resources.

Market indicators for supply & demand — RICS landlord instructions index, Rightmove listings, regional rent trends.

Final Thoughts

The momentum is shifting. What was once incremental regulatory creep is now accelerating into structural change. For landlords and investors, the task ahead is not just adaptation — but anticipatory strategic positioning.

Those who proactively audit their tax and compliance exposure, rerun stress scenarios, protect tenant relationships, and balance their portfolio risk will be better placed to act rather than react.

Citation / Source List

“Landlord tax investigations net HMRC record £107m” – MoneyWeek MoneyWeek+1

“HMRC recovers record £107m from landlord investigations” – The Negotiator The Negotiator

“HMRC rakes in record £107 m in landlord crackdown” – The Telegraph telegraph.co.uk

“Landlords forecast to exit BTL market in droves – has the exodus started?” – MoneyWeek MoneyWeek

“UK rental listings fall at fastest rate since Covid lockdown, survey shows” – FT / RICS data ft.com

“Rents reach record high as landlords brace for tax changes” – The Times / Rightmove data thetimes.co.uk

“Treasury ‘considering taxing landlords’ rent’ to raise £2bn” – The Guardian The Guardian

“Reeves warned tax hike on landlords will hurt tenants” – The Scottish Sun / commentary thescottishsun.co.uk

“UK Homeowners May Face New £500k Property Tax Levy” – UKPropertyAccountants UK Property Accountants

LandlordZONE: “Landlords will quit if forced to fund energy efficiency work,” “Landlords warned to watch for shorter notice periods,” etc. landlordzone.co.uk