UK Landlord News – Top 5 Issues for Residential & Commercial Investors

22nd October 2025

Welcome to this week’s briefing for landlords and property investors – both residential and commercial. The UK market is undergoing rapid change, and for those holding or acquiring rental assets, the shifts matter. Here are five major stories from the last seven days that deserve your attention. Each carries implications for your strategy, your compliance burden, your returns and risk exposure. I’ll lay out what’s happening, why it matters and what you should be doing now.

Reform of the private rented sector – the Renters’ Rights Bill (and the “new rules” for landlords)

One of the biggest stories this week is the progress of the Renters’ Rights Bill (RRB) and commentary signalling that the scale of reform for landlords will be among the largest in decades.

What’s new?

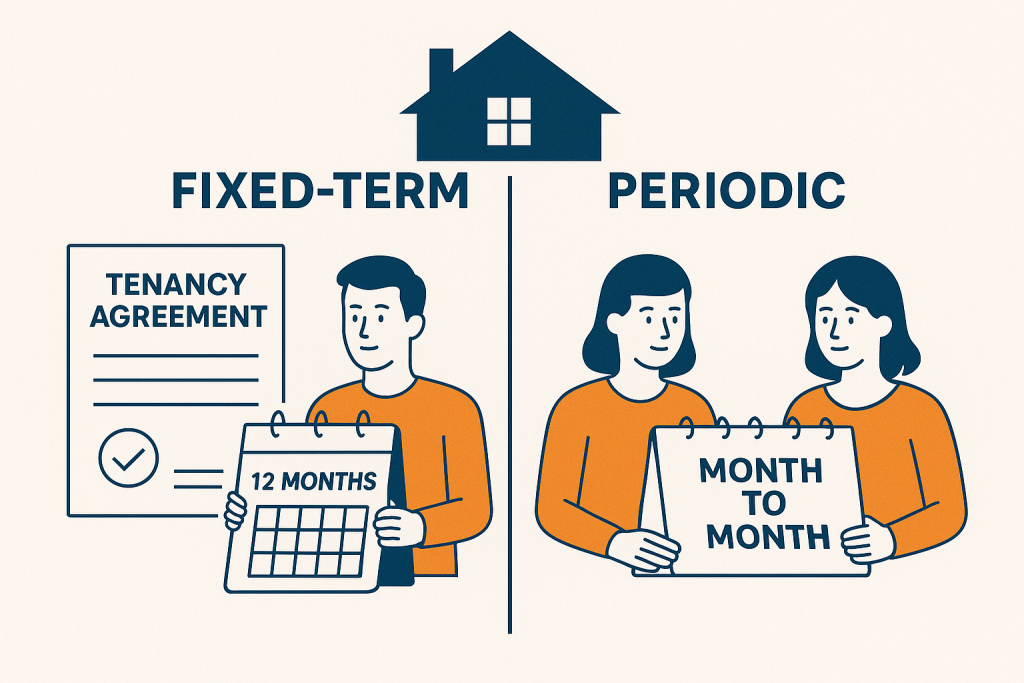

The RRB proposes a shift away from the current default of fixed-term Assured Shorthold Tenancies (ASTs) – landlords may have to adapt to a more periodic (month-to-month style) tenancy regime.

The notorious Section 21 “no-fault” eviction route is set to be abolished for new tenancies (and eventually all tenancies) so landlords will need to rely on the grounds under Section 8 (or equivalent) to regain possession.

Rent-increase mechanisms will be revised: landlords will have to use formal processes (rather than informal “market rent” reviews) in order to raise rents.

The Bill will place greater obligations on landlords: e.g., renewing energy certificates, increasing property standards, perhaps new dispute-resolution mechanisms for tenants.

Why it matters for landlords (residential & commercial):

The shift away from fixed-term ASTs means portfolio cash-flow planning becomes harder. If you currently rely on fixed 12- or 24-month tenancies, shorter-term tenancies expose you to greater risk of voids, tenants giving early notice, potentially lower tenant commitment.

Abolition of Section 21 means you cannot simply “terminate without cause” at the end of the fixed term. That reduces flexibility (e.g., selling the property, taking it back for personal use) unless you fit within the new grounds. Portfolio exits may become more complex.

The formalisation of rent-review processes means you may have to build a new operational workflow (notice periods, tribunal evidence, record-keeping) if you want to raise rent. For commercial tenants this may be less of a change (depending on lease length) but for multi-unit residential and small-scale landlords it represents additional administrative burden.

Increased obligations and standards means cost pressure. If you need to upgrade properties ahead of legislation, you may take a dip in profitability unless you have factored this in.

Implications / what you should be doing:

Audit your existing tenancy agreements. Are you still operating older ASTs? Fixed-term agreements expiring soon? It might be time to review exit strategy or renewal terms.

Consider whether your investor exit plan remains viable if you cannot exit via Section 21. If you were planning to sell or repurpose, build contingencies.

Review your rent-review procedures: document your current rents, comparable market rents, tenant records, communications so that if you need to raise rent you are well-placed.

Update your compliance register: note upcoming dates for when reforms take effect (some may be 2026), but preparing ahead is prudent.

Factor cost of extra regulatory burden into your yield forecasts – for commercial landlords as much as residential.

Rising cost burden and exit risk – energy performance & Energy Performance Certificate (EPC) reform becomes the main reason landlords are quitting

Another key story: according to recent data, the cost of upgrading to meet new energy-efficiency standards (i.e., better EPC ratings) is now the main reason landlords are opting to exit the sector.

What’s new?

A report indicates that among landlords leaving the market or planning to leave, the most common cited reason is EPC reform costs (rather than tax or regulation).

The proposed changes (England & Wales) include raising the minimum energy efficiency standard for new tenancies from EPC E to EPC C (and eventually for all tenancies) and overhauling how EPCs are calculated (more focus on heat retention rather than just energy use).

Landlords’ confidence in the EPC system is low: many say they do not trust the ratings or the advice about what improvements to make.

Why it matters:

Energy upgrades can be capital-intensive: loft insulation, double or triple glazing, heat pumps, etc. For commercial units, particularly older stock, the cost per unit of floor area is significant.

If landlords exit en-masse (or scale back), supply of rental property may tighten – pushing up rents, but also increasing repositioning risk if your property relies on secondary tenant demand.

For commercial landlords, if a building fails to meet EPC C (or equivalent) requirement, you may struggle to let or re-let; some lenders and investors are already excluding low-rated buildings.

Because many landlords are flagging an intention to quit rather than upgrade, this suggests a shift in market composition: fewer “amateur” landlords, consolidation among purpose-built, fully-compliant investors. That means increased competition and possibly more upward pressure on pricing for compliant stock.

What you should do:

Undertake an EPC audit of each property now. Identify which units/properties are below target rating and estimate uplift cost.

Prioritise high-return properties for investment (e.g., those already close to EPC C) and consider exit or repurposing (sale, change use) for those with high upgrade cost and weak yield.

For commercial assets, check lease structures – do tenant covenants allow for passing through energy-upgrade costs? Could you implement a service-charge or capex reserve?

Update your financial modelling: include potential voids, upgrade capex, rent growth assumptions and expected duration of compliance window.

Consider whether you might reposition property for a different use (for example converting to serviced offices, flexible workspace, HMO) if standard residential/commercial let becomes less viable due to cost.

Region-by-region yield shift – best UK areas for buy-to-let and what that means for investors

On the investment front, this week saw renewed data showing certain UK regions offering far stronger rental yields and capital-growth potential than others. For both residential and commercial portfolios, geography matters.

What the data says:

A recent analysis shows that Wales is the best-performing UK region for buy-to-let (BTL) landlords, offering yields around 8.84% (versus ~7.98% previously) and leveraging relatively low house-prices (median ~£227k) compared with the UK average (~£298k).

North East England follows with yield ~8.16%, then North West & South West both ~7.81%. Meanwhile, Greater London yields are much weaker (~5.65%) due to high entry-prices and lower yield spread.

The headline: high-yield investment opportunities are increasingly outside the “traditional” London/SE axis, especially for residential BTL.

Why it matters:

For residential landlords looking to maintain or increase yield, these regional data suggest a strategic shift may be required. Traditional London-centric portfolios are yielding less and may face higher regulatory/upgrade burdens.

For commercial landlords (especially multi-unit residential conversions, HMOs, mixed-use blocks) targeting secondary or tertiary cities may deliver both higher yield and stronger rental demand (from tenants priced out of prime markets).

The yield advantage also means that the upgrade burden (as per EPC, new tenancy rules, etc) may be more absorbable in higher-yield regions – you have more margin to invest. Conversely in low-yield areas you may struggle to have budget for compliance.

The regional gap matters for portfolio growth or repositioning: if you are expanding, this data supports looking more widely. If you are standing still, you should benchmark your yield against these high-yield regions and ask whether you are under-performing.

What you should do:

Benchmark your existing portfolio yields by region. Identify under‐performers (e.g., property in London or high-entry cost areas yielding <6%).

Consider whether switching a portion of your portfolio to higher-yield regions makes sense (e.g., acquisitions in Wales, North East, North West).

For commercial properties, consider sub-market demand: is there rental demand for multi-let flats, HMOs, serviced-apartments in those regions? Can you refurbish/up-grade to capture above-average yields?

Model exit or disposal of properties with low yield and high regulatory burden. Re-deploy capital into higher-yield, lower-burden regions.

Keep an eye on tenant profile: high-yield regions often correlate with student accommodation, young professionals, or areas of regeneration. Understand tenant demand and asset type accordingly.

Supply squeeze and landlord exodus – fewer owners, increased risk of voids & cost inflation

This week the narrative of a landlord exodus is gaining greater traction: more individual or smaller landlords are considering or executing market exit, accelerating supply squeeze.

What’s happening?

Recent polling shows about 1 in 3 landlords are considering selling at least part of their portfolios, especially those with only one or two units. The key reasons cited include rising regulation (tenancy reform, EPC requirements, rent-review changes) and cost pressures.

The departure of smaller landlords reduces rental-property supply, which can create upward pressure on rents and void risk for remaining landlords (if tenant demand stays constant).

Why it matters for landlords/investors:

For residential landlords: if supply drops, rental demand will intensify, especially in high-demand segments (e.g., inner city, student housing, coastal/friendly housing markets). That’s good for rent growth potential – but you still need compliant stock to benefit.

For commercial landlords: especially multi-unit residential or mixed-use blocks, if you can show compliant, upgraded stock you may benefit from reduced competition from amateur landlords exiting. That could allow you to reposition or increase premium.

On the flip side, with fewer ‘small landlords’ in the market, your tenant base may shift. Larger, professional landlords often operate differently (higher standards, higher rents). That may marginalise older stock or lower-grade properties.

Further, fewer landlords may lead to consolidation: professional landlords, institutional investors may pick up portfolios, creating competition for acquisitions and pushing up entry costs for smaller investors.

What you should do:

Review your tenant demand demographics: if supply is likely to tighten, assess whether you can raise rents or re-position your property for higher-income tenants.

Ensure your stock is maintained to high standard – if many smaller landlords exit due to poor compliance, you will benefit from being the compliant alternative. But if you lag, you risk being left with the weaker assets.

If you are a smaller landlord with one or two units, this is a moment of reflection: can you absorb the regulatory/upgrade cost and still generate acceptable returns? If not, consider exit or restructure (e.g., incorporate, portfolio with partner, partial disposal).

For commercial portfolios: assess whether you want to pick up disposal opportunities from exiting landlords, or whether your own holdings are under threat from consolidation pressures.

Safety and quality regulations – from Awaab’s Law to damp & mould focus, enforcement is rising

Finally, landlord compliance on property quality and safety remains in sharp focus this week, with an emphasis on new legislation around damp/mould and landlord liability.

What’s happening?

Social housing landlords are already subject to the Awaab’s Law regime (from 27 October 2025) which mandates that dangerous damp and mould must be investigated and fixed within tight timeframes (e.g., 24 hours for emergencies).

While it currently applies mainly to social housing providers, the wider field of rental stock (private landlords, commercial property with residential components) is under scrutiny. Many property-maintenance firms report a surge (340 % increase) in mould/damp enquiries from landlords ahead of the law enforcement date.

Expectations are that private landlords will face similar obligations in due course.

Why it matters:

For any landlord owning residential rental stock (including multi-let commercial/residential blocks) the standard of habitability is no longer an afterthought. Failure to address damp, mould, water ingress etc may result in enforcement action, remediation costs, possible re-housing requirements and reputational damage.

For commercial landlords with mixed use (e.g., upper-floor residential above retail), the issue is acute – you may face residential regulation as part of the building compliance.

In the context of the RRB and EPC reforms, the habitability/safety regime adds one more layer of cost and risk. For investors, this means compliance estates are becoming more complex and capital intensive.

On the positive side: landlords who proactively manage property-condition risk will gain a competitive advantage in the rental market (tenants prefer better-maintained stock) and may mitigate voids/tenant turnover.

What you should do:

Review your entire portfolio’s property-condition risk: damp, mould, structural issues, ventilation, water ingress, roof leaks. For commercial stock, check whether residential elements are fully separated and compliant.

Implement a maintenance audit and schedule: for each property list known issue-areas, planned remediation, time-frame and budget.

Consider the cost of re-housing tenants or legal remediation in worst-case scenarios – build reserves accordingly.

For new acquisitions: include due-diligence for damp/mould risk, especially in older buildings or where there is evidence of previous tenant complaints.

Communicate to your tenants your proactive maintenance plan – this helps reduce turnover and may reduce risk of complaints/litigation.

Summary – what this means for your strategy

Taken together, these five stories highlight a clear trend: the landlord/investor landscape in the UK is shifting from “passive rental owner” to “active portfolio manager”. The regulatory, compliance and cost burdens are rising, and the reward for doing nothing is shrinking. Here’s how to think about it from a strategic perspective:

Yield & region matter more than ever. With regulatory cost climbs and weaker yields in prime markets like London, secondary and tertiary regions with higher yields become more compelling.

Operational excellence becomes a differentiator. It’s no longer enough to own the property and let it out. You need systems to manage tenancy compliance (RRB), energy-efficiency upgrades (EPC), safety/maintenance (Awaab’s Law type risk) and tenant demand.

Exit planning is vital. If a property has low yield, imminent high-capex regulatory cost or is in a region with weak demand, you must ask: hold and invest, reposition, or sell?

Commercial and residential portfolios converge. Whether you hold multi-unit residential, single-lets, mixed-use or purely commercial, the underlying obligations (EPC, safety, tenant rights) are increasingly comparable. The difference now is asset type, tenant profile and risk appetite.

Acquire with caution and due diligence. If you are expanding or buying new stock: focus on assets that are compliant or near-compliant (so you don’t face huge unexpected capex), in higher yield regions, and with a tenant base aligned to demand.

Value the compliant edge. Landlords who move earlier, invest in property-condition, process, tenant experience, energy efficiency and compliance will gain in a market where many smaller operators are exiting.

From the vantage of Index Property Services, our advice to you this week is: conduct a full review of your portfolio against these five dimensions (tenancy regime and rights, EPC/energy-upgrade risk, region/yield, landlord exit risk, property-condition/safety). For any weak spot, draw up a 90-day remedial plan. Given the scale of change now underway, the best-positioned landlords will be those who act early rather than wait for legislative or compliance “deadlines” to hit.

Here’s to staying ahead of the curve and ensuring your portfolio remains resilient, compliant and profitable.

Citation list

“Damp & Mould Laws For Landlords As Awaabs Law Set To Take Effect October 27th” (OpenPR) – 340% surge in mould-related enquiries. openPR.com

“EPC reform cost now main reason for landlords quitting” (Landlord Today) – cost cited as main driver of landlord exits. Landlord Today

“The New Rules of Being a UK Landlord” (Bloomberg) – major shake-up for landlords and buy-to-let investors in decades. Bloomberg

“Revealed: The best UK regions for buy-to-let landlords” (MoneyWeek) – yield data by region. MoneyWeek+1

“Changes to energy efficiency rules for rental properties” (Simply Business) – explanatory guide on EPC reform. Simply Business UK

“The Renters’ Rights Bill: What landlords, property managers and surveyors need to know” (Howden / RPC) – guide to the Bill and implications. Howden Group

“Renters’ Rights Bill could spark landlord exodus and drive up rents, brokers warn” (MPA Mag) – commentary on the Bill’s supply impact. Mortgage Introducer

“The impact of good landlords exiting the rental sector” (LandlordZONE) – survey of landlords’ exit intentions. LandlordZONE

“Landlords lose confidence in the EPC system as many plan to sell” (Property118) – confidence data on EPCs. Property118

“Awaab’s Law: Guidance for social landlords” (GOV.UK) – official guidance for compliance from 27 Oct 2025. GOV.UK