This Week’s Top Property News for UK Landlords: 6 Key Stories Shaping the Market (September 8-14, 2025)

As we navigate the evolving landscape of UK property investment, this week has delivered several critical developments that every landlord should understand. From legislative changes to market movements, here’s our comprehensive analysis of the six most significant stories affecting both residential and commercial property investors.

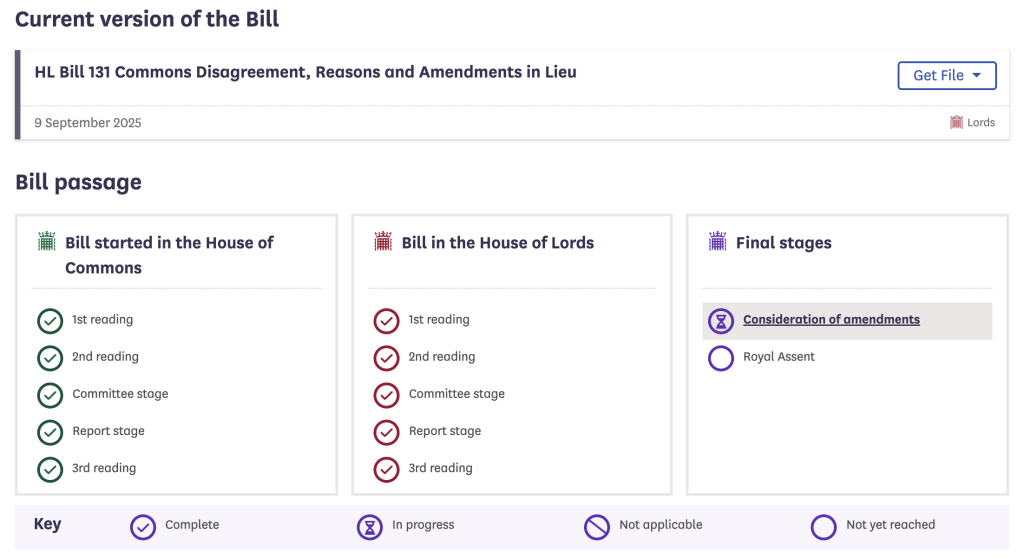

1. Renters’ Rights Bill Moves Closer to Royal Assent Despite Industry Opposition

The Big Story: On Monday, September 8th 2025, MPs debated final amendments to the Renters’ Rights Bill, but the majority of proposed changes were rejected, clearing the path for Royal Assent as early as mid-September.

What This Means for Landlords: The Bill is now essentially finalised with minimal changes from its original form. Housing Minister Matthew Pennycook emphasised the government’s mandate to “modernise the regulation of our country’s insecure and unjust private rented sector.” Key provisions that will affect landlords include:

- Section 21 abolition confirmed: No-fault evictions will be completely eliminated for all tenancies

- Rent increase limitations: Only Section 13 notices will be valid for rent increases, limiting increases to once per year

- Pet deposit rejection: The government rejected allowing landlords to charge separate pet deposits of up to three weeks’ rent

- Property sale restrictions maintained: The 12-month re-letting ban remains for properties where sales fall through

Industry Impact: Despite concerns from landlord associations about driving investors out of the market, Shadow Housing Secretary Sir James Cleverly’s warning that the Bill is “entirely counterproductive” was dismissed by the government.

2. Buy-to-Let Mortgage Rates Hit Three-Year Low Providing Relief to Investors

Market-Moving News: Buy-to-let mortgage rates have dropped to their lowest levels since September 2022, with average two-year fixed rates falling to 4.88% and five-year rates to 5.21%.

The Numbers That Matter:

- Product availability has reached a record high of 4,597 deals

- Landlords who locked into rates in 2023 will see dramatic savings on refinancing

- Rates have consistently stayed below 5% since June 2025

Strategic Implications for Landlords: This represents the first genuine good news for landlords in years. Rachel Springall from Moneyfacts notes that “those landlords who locked into a fixed rate deal in 2023 and are due to refinance will find the average two-year fixed rate has fallen from 6.64% to 4.88%.”

However, this positive development comes alongside speculation about potential National Insurance charges on rental income, which could offset mortgage savings for unincorporated landlords.

3. Landlord Instructions Drop to Five-Year Low Amid Budget Uncertainty

Market Reality Check: The latest RICS Residential Market Survey reveals a net balance of -37% of respondents reported falling landlord instructions – the steepest decline since April 2020.

Behind the Numbers:

- Tenant demand continues rising with a net balance of +5%

- Rent expectations show +27% of surveyors predicting increases over the next three months

- Annual rent growth forecasts remain around 3% nationally

What’s Driving the Decline: Russell Anderson from Paragon Bank identifies this as “further evidence that supply is failing to meet the continuing demand for privately rented homes.” The timing coincides with concerns about potential property tax changes in the upcoming Autumn Budget.

Commercial Implications: This supply-demand imbalance is creating a challenging environment where rental property scarcity is pushing up rents while limiting tenant choice – a situation that ultimately impacts the broader economy by reducing workforce mobility.

4. Rental Yields Reach 13-Year High Despite Market Challenges

Positive Investment News: UK rental yields have climbed to their highest level in 13 years, averaging 6.93% in Q4 2024, according to Paragon Bank research.

Regional Breakdown of Top-Performing Areas:

- Wales leads with average yields of 8.09%

- North West England follows at 7.84%

- South West delivers 7.75% average returns

- London remains lowest at 5.48% despite premium rental values

Strategic Investment Insights: The North West continues to dominate performance metrics, with Manchester achieving yields up to 12% in high-performing areas. This aligns with separate research showing the North West as one of the UK’s top locations for house price growth, making it particularly attractive for investors seeking both yield and capital appreciation.

For Commercial Investors: Similar trends are emerging in commercial property, with logistics and industrial sectors showing substantial reversionary potential, particularly in northern cities where rental values remain below market levels.

5. Rent Increase Regulations Tighten Under New Legislative Framework

Regulatory Update: The Renters’ Rights Bill introduces significant changes to how landlords can increase rents, with implications for cash flow management and investment planning.

Key Changes Landlords Must Understand:

- Rent review clauses in tenancy agreements will become unenforceable

- Only Section 13 statutory notices will be valid for rent increases

- Landlords must provide stronger justification for increases

- Tenants gain enhanced rights to challenge rent rises through tribunals

Practical Impact: Allison Thompson from Leaders Romans Group advises that landlords should begin preparing now by removing rent review clauses from agreements and maintaining detailed records of rental market comparisons. The longer lead times for rent adjustments may impact cash flow, particularly in rapidly rising markets.

Planning Ahead: Landlords will need to monitor local rental trends more closely and plan increases well in advance, with clear evidence of market rates to reduce the likelihood of tenant challenges.

6. London Rental Supply Crisis Deepens Despite National Market Improvements

Capital Concerns: London’s rental market is experiencing acute supply shortages, with properties leaving the market faster in the most affordable areas of the capital.

The London Paradox: While national rental supply has increased by 17% year-on-year, London faces a different reality. Ben Beadle from the NRLA warns that “private renters across London are facing the brunt of the housing crisis” with the shortage creating “a one-way street toward higher rents and even less choice for tenants.”

Investment Implications:

- Central London areas like Victoria, Pimlico, and Westminster still command yields around 5%

- Regeneration projects are opening new opportunities for buy-to-let investors

- Foreign investment is expected to surge as interest rates decrease

Commercial Opportunities: The supply shortage is creating opportunities in mixed-use developments and build-to-rent projects, particularly in regeneration areas like Church Street in Marylebone and Paddington Square.

Market Analysis: What These Trends Mean for Your Investment Strategy

For Residential Landlords:

Short-term Actions:

- Refinancing Opportunity: With rates at three-year lows, now is an ideal time to review mortgage arrangements

- Documentation Review: Update tenancy agreements to remove unenforceable rent review clauses

- Market Research: Build comprehensive databases of local rental comparisons for future rent increases

Medium-term Strategy:

- Geographic Focus: Consider expansion in high-yield areas like Wales and North West England

- Legislative Preparation: Develop systems to comply with enhanced tenant rights and court processes

- Technology Investment: Implement property management systems to handle increased compliance requirements

For Commercial Property Investors:

Emerging Opportunities:

- Logistics Sector: Strong reversionary potential in northern cities where rents remain below market levels

- Mixed-Use Developments: London regeneration projects offer entry points despite overall supply constraints

- Regional Cities: Manchester, Birmingham, and Bristol continue showing strong fundamentals

Risk Management:

- Balance Sheet Strength: Focus on lower-leverage investments given ongoing economic uncertainty

- Rental Growth Potential: Prioritise assets with inflation-linked increases or substantial reversionary potential

- Exit Strategy Planning: Consider how potential regulatory changes might affect disposal plans

Looking Ahead: Key Dates and Developments to Monitor

Immediate Timeline (September 2025):

- Mid-September: Expected Royal Assent for Renters’ Rights Bill

- September 16: Labour Party Conference begins

- October: Implementation regulations for Renters’ Rights Act expected

Critical 2025-26 Milestones:

- November 26, 2025: Autumn Budget 2025 (watch for tax changes)

- April 1, 2025: New stamp duty rates take effect (threshold drops from £250,000 to £125,000)

- April 2026: Making Tax Digital compliance required for landlords earning over £50,000

Market Predictions for 2025:

- Rent Growth: 3-4% nationally, with regional variations

- Mortgage Rates: Expected to stabilise around current levels

- Investment Activity: 15% increase predicted by CBRE as rates stabilise

Expert Recommendations for Landlords

Based on this week’s developments, property investment experts recommend:

- Immediate Action Required: Review and update all tenancy documentation to ensure compliance with incoming regulations

- Financial Planning: Model the impact of potential National Insurance changes on rental income

- Geographic Strategy: Consider portfolio diversification toward higher-yielding northern regions

- Professional Support: Engage with specialist advisors to navigate the increasingly complex regulatory environment

The property investment landscape is undergoing its most significant transformation in decades. While challenges are substantial, opportunities remain for landlords who adapt quickly and strategically to the changing environment.

The key to success in 2025 will be balancing compliance with profitability, while positioning portfolios to benefit from evolving tenant demands and market dynamics. Those who embrace these changes and plan accordingly will be best positioned to thrive in the new regulatory environment.

Citation List

Primary Sources:

- Landlord Today – “Landlords finally get some goods news as buy-to-let rates drop” – September 11, 2025 https://www.landlordtoday.co.uk/breaking-news/2025/09/landlords-finally-get-some-goods-news-as-buy-to-let-rates-drop/

- Property Notify – “Final Steps for Renters’ Rights Bill?” – September 11, 2025 https://www.propertynotify.co.uk/news/final-steps-for-renters-rights-bill/

- Letting Agent Today – “RICS: Landlord instructions hit five-year low” – September 11, 2025 https://www.lettingagenttoday.co.uk/breaking-news/2025/09/rics-landlord-instructions-hit-five-year-low/

- Landlord Today – “Rent increases under review: What landlords need to know” – September 13, 2025 https://www.landlordtoday.co.uk/features/2025/09/rent-increases-under-review-what-landlords-need-to-know/

- The Negotiator – “Rental crisis in London ‘deepens further’, landlords warn” – July 17, 2025 https://thenegotiator.co.uk/news/rental-market/rental-crisis-in-london-deepens-further-landlords-warn/

- BuyAssociation Group – “Rental yields: Where can landlords get top returns in 2025?” – February 26, 2025 https://www.buyassociationgroup.com/en-us/news/landlords-25-rental-yields/

Government and Official Sources:

- GOV.UK – “New law to protect renters one step closer to becoming a reality” – January 14, 2025 https://www.gov.uk/government/news/new-law-to-protect-renters-one-step-closer-to-becoming-a-reality

- GOV.UK – “English Private Landlord Survey 2024: main report” – December 5, 2024 https://www.gov.uk/government/statistics/english-private-landlord-survey-2024-main-report/english-private-landlord-survey-2024-main-report

Market Data Sources:

- Zoopla – “Rental Market Report: June 2025” https://www.zoopla.co.uk/discover/property-news/rental-market-report/

- Simply Business UK – “Autumn Budget 2025: latest predictions for landlords” – September 4, 2025 https://www.simplybusiness.co.uk/knowledge/landlord-news/autumn-budget-2025-for-landlords/

Industry Analysis:

- Total Landlord Insurance – “Key dates for landlords: What does 2025 have in store?” – September 7, 2025 https://www.totallandlordinsurance.co.uk/knowledge-centre/key-dates-for-landlords

- Property118 – “Property income from landlords reaches record levels” – September 7, 2025 https://www.property118.com/landlord-property-income-record-2024/

- NRLA – “The UK property market and buy to let in 2025” https://www.nrla.org.uk/news/the-uk-property-market-and-buy-to-let-in-2025

Additional References:

The Independent Landlord – “What’s new for landlords in 2025?” https://theindependentlandlord.com/landlords-2025/

Landlord Studio – “Changing Markets: New Landlord Rules 2025?” – July 16, 2025 https://www.landlordstudio.com/uk-blog/landlords-finances-in-2025